Too Long Didn’t Read Summary

- Travelex’s majority shareholder Dr Shetty may be subject to a margin call which could result in a change of control under Travelex’s 2022 Notes

- However – if lenders wish to enforce, they may be able to structure a share sale to avoid a 101% put being triggered

- Dr Shetty may also be able to post alternative collateral or refinance the margin loan in question

Muddy Waters & NMC’s link to Travelex

Yesterday saw an extraordinary statement from NMC Health which revealed the removal of its CEO, the long-term sick leave of its CFO and a series of financing transactions that had not been approved by the Board. This resulted in the suspension of its stock this morning and is just the latest development in an ongoing battle between the FTSE100 business and short seller Muddy Waters.

The governance nightmare unfolding at NMC first caught our eye earlier this year due to the involvement of NMC’s shareholder & founder Dr Shetty. Dr Shetty is the controlling shareholder of Travelex (via listed parent Finablr).

NMC’s shareholding has been revealed to be a complex web of MoUs, related party transactions and margin loan facilities (where debt facilities are raised through granting security against shareholdings).

In recent weeks it has become apparent that the NMC story extends to Finablr, so we’ve been exploring how Travelex bondholders could be impacted by the deterioration in Dr Shetty’s financial situation.

In particular we’ve focused on any change in Dr Shetty’s ownership of Finablr and whether that could trigger a change of control under Travelex’s Notes. This only really became relevant from 7th January when Travelex’s Notes dropped below 101 on the news of its Cyber-attack.

We start with the definition of a Change of Control under Travelex’s 2022 Notes. This contains pretty typical language

- A 50% beneficial ownership of the Company as the threshold for a trigger event

- the Company is “TP Financing 3 Limited” and its successors

- Permitted Holders are the Principals which include Dr Shetty, Mr Al Muhairi and Mr Al Qebaisi

Before we look at the current ownership structure, it’s useful to explore the ownership history of Travelex and its listed parent Finablr.

Who owned Travelex before Finablr’s IPO?

Prior to Finablr’s IPO, the Principals indirectly held a 95% ownership stake in Travelex. We’ve included the original structure chart, but it unhelpfully bundles the ownership into a “Stockholders” box at the top – so we’ve broken it down below.

- Dr Shetty owned 91% of the shares in BRS Ventures & Holdings Limited, Mr Al Muhairi and Mr Al Qebaisi each held a 4.5% stake

- BRS Ventures & Holdings Limited owned 95% of the shares in UTX Holdings Limited, with the remaining 5% held by Mr Dorfman (the founder of Travelex) and a Childen’s Settlement in his name

- UTX Holdings Limited owned 100% of the shares in Travelex Holdings Limited

- Travelex Holdings Limited owned TP Financing 3 Limited via a series of intermediate holding companies which have since been liquidated to simplify the group structure

The BRS Facility & Dr Shetty’s acquisition of Travelex

Travelex’s old bonds were ported as part of Dr Shetty’s acquisition of the business in 2014, these were subsequently refinanced in 2017 with the current 2022 Notes.

The 2014 acquisition was reported to value the business at £1bn. With around £200m of net debt at that point (excl. cash in tills & regulatory cash) that suggests consideration to the sellers (Apax and Mr Dorfman) of £800m.

What’s interesting about the acquisition is where the ‘equity’ to fund the transaction came from. $750m of debt (eq. £450m at the time) was raised at the holding company level via BRS Ventures & Holdings Limited.

This BRS Facility was effectively a margin loan to Dr Shetty & the other Principals as UTX Holdings pledged the shares it held in Travelex as collateral. This BRS Facility was downsized and amended in 25th March 2016. More on this later.

Who owned Travelex after Finablr’s IPO?

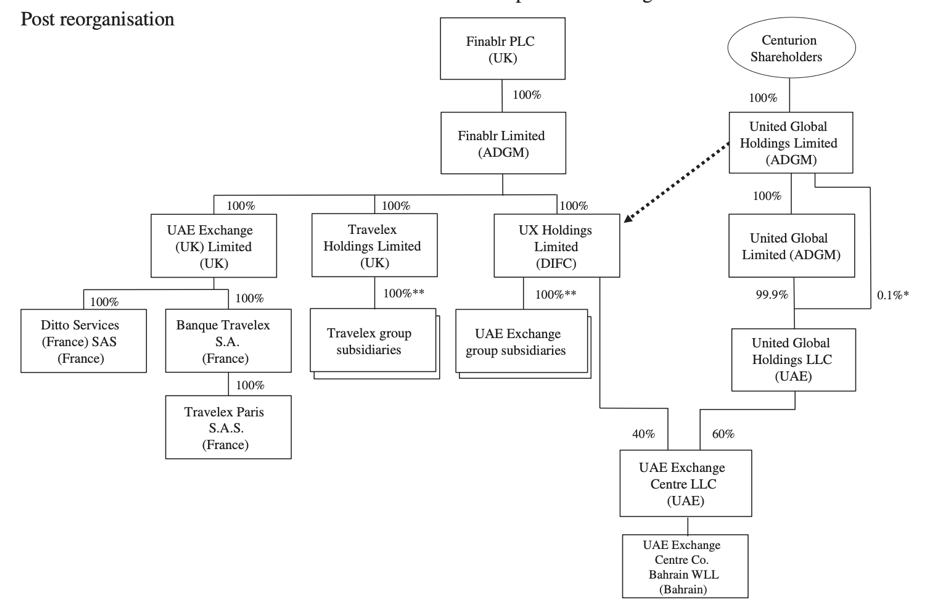

That brings us to Finablr’s IPO in 2019. Unlike the Travelex OM, the registration document nicely summarises the organisational structure pre and post IPO. In a nutshell, a reorganisation resulted in Finablr Limited acquiring all the share capital of Travelex Holdings Limited.

This reorganisation didn’t trigger a Change of Control because pro forma for the listing Dr Shetty and Principals still held more than 50% of Travelex indirectly via their shareholding of Finablr. (64.2% Dr Shetty via BRS Investment Holdings 1 Limited, BRS Investment Holdings 2 Limited, BRS Investment Holdings 3 Limited and 3.4% Mr Al Muhairi and 3.4% Mr Al Qebaisi via UX Investment Holdings Limited). We've included the relevant excerpts from the regulatory filings below.

Travelex ownership developments in 2020

The 7th January “Margin Call” and the Nov Partners Facility

That brings us up to this year. After Muddy Waters short attack in Dec-19. On 7th January Credit Suisse and Deutsche Bank launched a share sale of $490m of NMC shares and $75m of Finablr shares owned by Mr Al Muhairi, Mr Al Qebaisi – two of the Principals under Travelex’s Permitted Holders.

This $75m represented about 6% of Finablr, or nearly all of their holdings in the company. The share sale proceeds were used to “reduce outstanding indebtedness of themselves and other corporate entities owned by them under borrowings raised by Nov Partners Investment Limited, entered into with, among others, Credit Suisse AG and Deutsche Bank”.

In effect two of the Principals were margin called. Subsequent filings on 21st of February confirm that NMC shares held by entities controlled by Al Muhair and Al Qebaisi were a) previously pledged as collateral and b) have since been part sold by United Arab Bank and Al Salam Bank Bahrain as enforcement of security.

For completeness their residual Finablr shares are subject to a 90 day lockup - given they previously owned 6.8% post IPO these are now likely to be at de minimus levels.

Dr Shetty’s current holding in Travelex and the return of the BFS Facility

On 24th January Finablr issued a statement (below) saying that 56% of its total shares had been pledged as security by BRS Investment Holdings 1 Limited. This is the entity through which Dr Shetty holds nearly all of his Finablr stake. The pledge is to secure the same BRS Facility we referred to earlier that was used to fund the Travelex acquisition (note the same Issue Date of 25th March 2016).

It seems that after Finablr’s IPO the Travelex Holdings Limited shares originally pledged by Dr Shetty were replaced or updated with Finablr shares as the new collateral package. Why does this matter? Because Dr Shetty could face a margin call on the BFS Facility.

There’s more evidence from a second statement by Finablr on the 24th January to support this prospect. As Finablr’s share price plummeted it released a statement saying it had been ‘reassured’ about the level of security represented by its shareholding in Finablr and the possible repayment / refinancing of the BRS Facility.

We stress that we have not seen the BRS Facility agreement, but its terms and this statement by Finablr go to the heart of whether Travelex Noteholders may be entitled to a Change of Control put at 101.

The BRS Facility Terms

- The BRS Facility was last disclosed as being $490m in the Travelex OM (although it is possible that it has been amended or restated).

- The Facility is listed as having a maturity in Mar-21 and annual amortization (the next amortisation payment may even be due next month given the maturity).

- Citi, GS, Qatar National Bank, Doha Bank, Barclays, Commercial Bank International and National Bank of Fujairah were all involved in arranging the original deal

- The Facility has a financial covenant, no further details are provided but post Finablr IPO this is likely to be LTV based

- Margin loan facilities are notoriously opaque, but LTV tests we’ve seen before have been in the ~ 50% area

Is a margin call likely to have been triggered?

The share price is pretty volatile, but at the current level of 59 Finablr’s entire market cap is just £420m or $540m eqv., that values Dr Shetty’s pledged stake at ~ £231m. Of course there could be additional collateral or a different financial covenant, but assuming just Finablr shares are pledged and there is $490m (£380m eq) in principal still outstanding that’s an LTV of north of 160%... (Note: This could be substantially lower on an LTV basis if the annual amortisation is significant)

That suggests that Finablr’s share price fall could have triggered a margin call under the BRS Facility. If this is the case unless Dr Shetty can a) post additional collateral acceptable to lenders (presumably cash or other acceptable assets) b) secure a waiver or c) refinance, the banks could enforce their security and sell some or all of Dr Shetty’s holding in Finablr.

Indeed the possibility of a margin call share sale enforcement was explicitly disclosed as a risk factor in the Travelex OM.

Would a margin call enforcement trigger a change of control under Travelex’s 2022 Notes?

Not necessarily. Assuming Mr Al Muhairi and Mr Al Qebaisi’s remaining Finablr stake is de minimus, only a small portion of Dr Shetty’s holdings would need to be sold to take the Principal’s ownership below 50%. However - that in itself would not be a change of control - the definition requires a “Person” or “Group” of “related persons” to have more than 50% beneficial ownership.

Depending on the enforcement mechanics under the BRS Facility, lenders may be able to partially enforce and sell shares representing less than 50% of Finablr’s shares, or enforce in a series of transactions which avoids them having greater than a 50% beneficial ownership interest at any point.

For example

- Step 1 – Enforce over shares representing 40% of Finablr’s shares, sell them to unrelated parties

- Step 2 – Enforce over the remaining pledged shares

We will keep 9fin subscribers updated on any new developments, we note that Finablr expects to clarify its shareholdings by the end of February. Watch this space...