As most firms have now reported Q2/H1 2020 figures, we’ve been reviewing 9fin’s financials database to assess sales performance across the European High Yield market. Key Trends Quarterly sales dropped -21.5% in Q2 versus prior year. On an LTM basis sales declined slightly in Q1 (-1.3%), with real effects of the pandemic felt in Q2 (-6.6%) Sales performance was largely Beta driven, with the exception of a few ‘lockdown winners’. The most impacted Sector - Hotels, Resorts & Cruise Lines - saw an average drop of -93.7% across five names. Unsurprisingly a correlation can be seen between credit strength and sales performance year on year; double BB (-15.4%), Single B (-18.4%), CCC+ & below (-42.1%).

By Industry Quarterly performance by Industry (L1):

‘Winners’: IT (+0.9%) and Consumer Staples (+0.3%) were the only Industries to make ground versus their comparable 2019 period. Other defensive Industries like Healthcare (-4.8%), Utilities (-4.9%), and Real Estate (-6.5%) managed to retain the majority of their revenue.

Losers: Spread across two groups; High Betas were worst affected, with Consumer Discretionary down -44.5%, Energy -35.7%, and Industrials -27.2%. The next grouping, Financials, Communication Services, and Materials all saw falls of 15-17%.

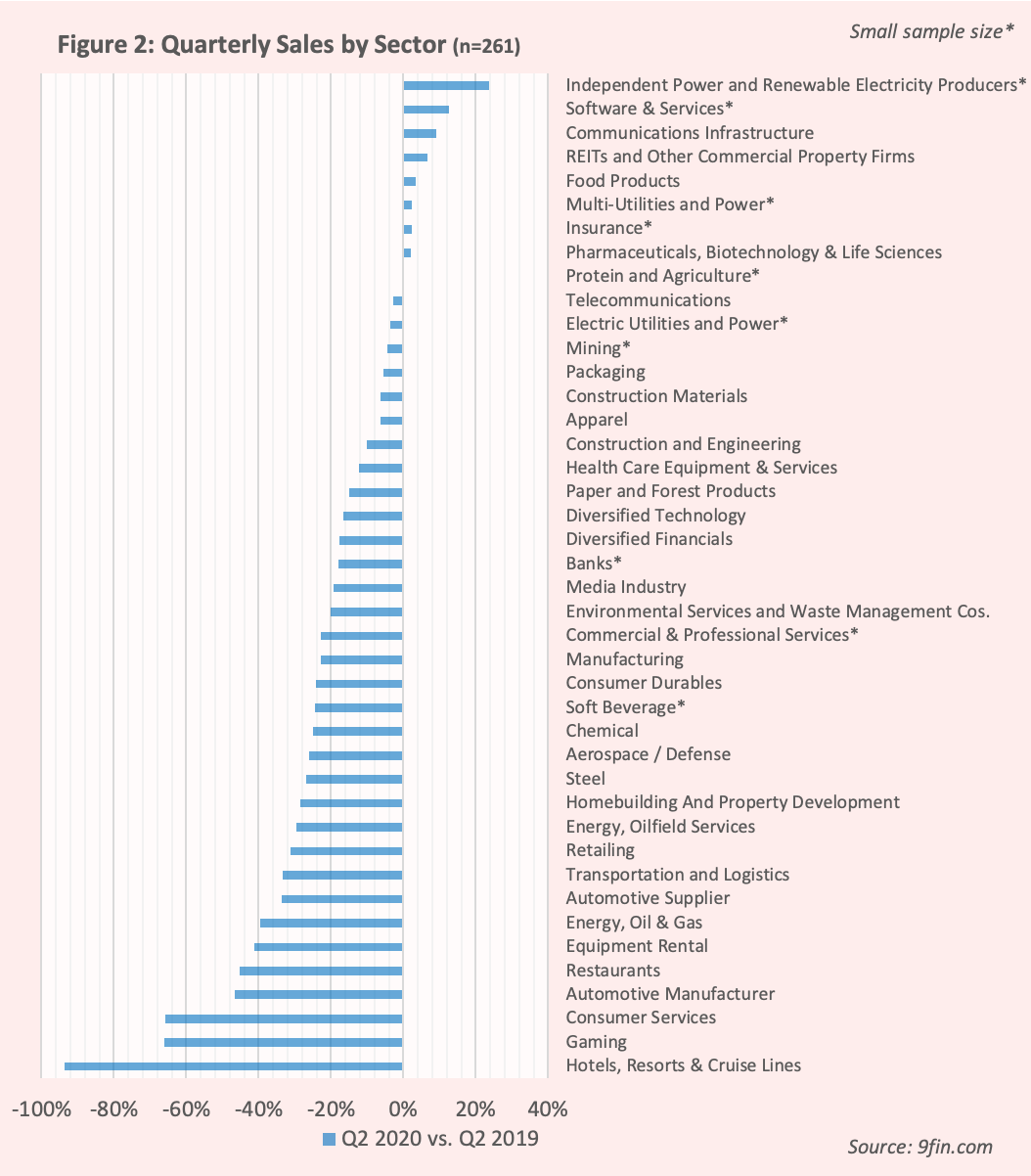

Sector Granularity A closer look at our second Industry level which provides a more granular breakdown of sectors (L2):

Hotels, Resorts & Cruise Lines took the greatest hit, losing an average of -93.7% of revenues versus the same period in 2019. There’s very little variance here, mass lockdown closures dried up sales across the board (see Merlin, Center Parcs, Travelodge, and hoteliers NH & Radisson). Automotive Manufacturers also suffered, down -46.6%. The notable exception is Renk AG - which saw a +12.3% rise, with a top line protected by extensive military contracts. Transport and Logistics are a mixed bag (-33.4%). While airlines and related services crashed (SAS Group -81.3%, Finnair -91.3%, Heathrow -84.9%, Swissport -70.8%), some transporters and freighters performed well (SFI +6.8%, SGL +37.4%, Teekay Corp +4.4%). Likewise, a Retailing drop of -31.3% hides a +26.8% rise from DIY firm Maxeda, which has benefitted from a wave of lockdown home improvements. At -12.2%, Health Care Equipment & Services mixes in the likes of medical device firm LimaCorp (-36.0%) and IDH (-32.2%) who postponed or cancelled surgeries/ treatments, with more resilient laboratory testing firms outperforming (Cerba +5.6%, Synlab +5.5%, Unilabs +4.2%). Food Products also varied markedly (+3.4%). Frozen food firms (Picard +24.4% and Iceland +27.1%) saw demand boosts, while event catering firms like Aramark (-46.3%) saw their end market evaporate. Communication Infrastructure (+9.0%) derives growth mainly from Cellnex sales growth (+47.5%), which is a mixture of organic growth, BTS programs and M&A (excl. Cellnex sector sales growth is flat).

LTM Basis We turn to revenue progression throughout the year, using LTM figures to account for seasonality:

LTM Q1 2020 vs. FY 2019: Some sales depression shown across majority of Industries - notable exceptions are; IT (+1.4%), Healthcare (+1.1%), and Consumer Staples (+0.3%). Average decline of -1.3%. LTM Q2 2020 vs. FY 2019: Sweeping declines in revenue across all Industries, bar IT (+1.6%), averaging -6.6%. Effects compounded for Industrials (-7.7%), Consumer Discretionary (-13.8%), and Energy (-10.2%). For Energy, the effects of March’s Russian-Saudi oil price war preceded the pandemic in Europe, meaning we see a notable impact in Q1, compounded in Q2 by a broader shutdown. Communication Services (-5.6%) saw gains amongst some digital media and Telco providers, however Gaming and physical media providers suffered (Telcos alone were +0.5%).

By Rating

|

|

|